Empower Your Funds With Cooperative Credit Union

Cooperative credit union have ended up being a sign of wish for individuals seeking to take control of their economic future. With a focus on customized solutions, affordable prices, and community assistance, credit scores unions supply an unique approach to financial empowerment. By lining up with a cooperative credit union, individuals can access an array of advantages that might not be readily available through conventional financial establishments. The concern stays: exactly how can cooperative credit union really transform your economic outlook and provide a steady foundation for your future ventures?

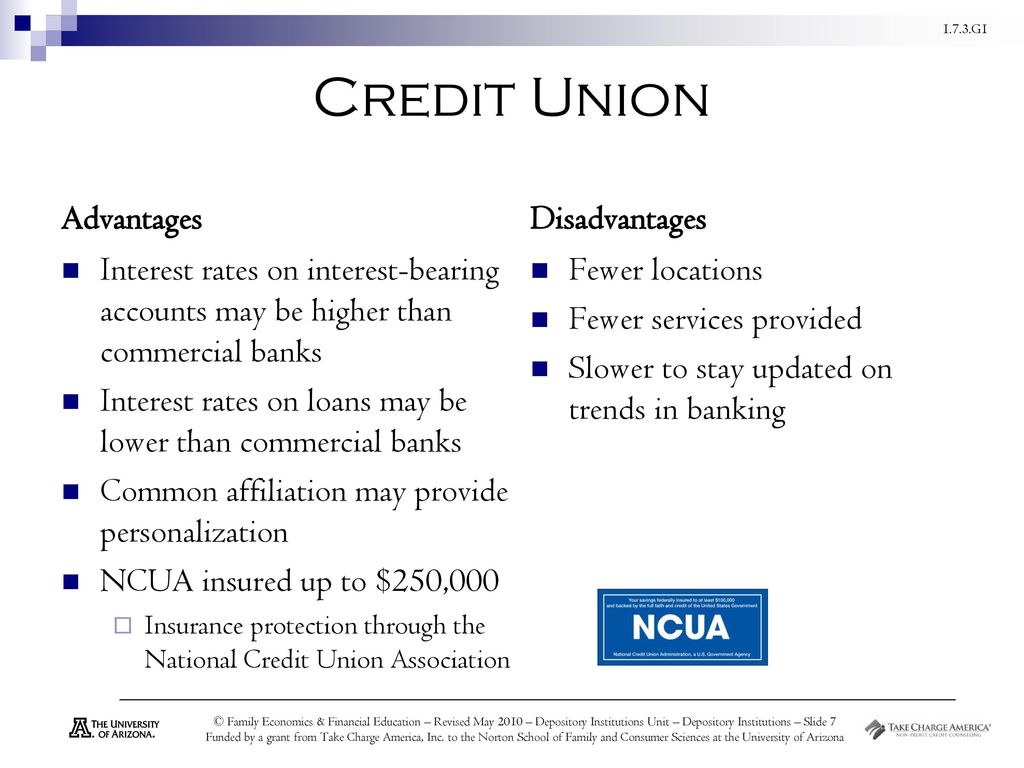

Advantages of Signing Up With a Cooperative Credit Union

Signing up with a lending institution uses numerous benefits that can boost your monetary health. One of the vital benefits is the possibility for higher rates of interest on cost savings accounts compared to traditional financial institutions. Lending institution are member-owned, not-for-profit banks, permitting them to prioritize supplying competitive rates to their participants. Additionally, lending institution commonly have reduced fees and car loan prices, helping you save money in the future.

Another benefit of belonging to a credit scores union is the customized service and community-focused technique. Unlike large financial institutions, credit unions frequently focus on structure connections with their participants and comprehending their unique economic demands. This can cause customized financial remedies, such as individualized loan choices or assistance on improving your credit history. Debt unions are understood for their dedication to economic education and learning and empowerment, supplying resources and workshops to help members make educated choices about their money.

Exactly How Cooperative Credit Union Offer Financial Education

Financial education and learning is a foundation of credit scores unions' ideology, highlighting the relevance of monetary proficiency in accomplishing long-term financial wellness. Members profit from learning exactly how to effectively handle their money, prepare for the future, and navigate complicated economic systems. These instructional sources not only benefit private members however additionally contribute to the total monetary health of the community.

Additionally, lending institution may partner with schools, neighborhood organizations, and neighborhood services to increase their reach and influence. By working together with outside stakeholders, cooperative credit union can better advertise monetary education and empower even more people to take control of their financial futures.

Accessibility to Competitive Finance Rates

To better boost the financial wellness of their members, credit unions offer accessibility to competitive car loan prices, making it possible for individuals to protect funding for various requirements at beneficial terms. Wyoming Credit Unions. Unlike typical banks, credit rating unions are not-for-profit organizations that exist to offer their members.

Lending institution commonly focus on the monetary well-being of their participants over optimizing revenues. This member-centric method converts right into providing fundings with reduced rates of interest, less charges, and a lot more adaptable terms compared to lots of typical economic organizations. Additionally, lending institution might be extra happy to work with people that have less-than-perfect credit scores histories, supplying them with chances to improve their economic circumstances with liable loaning. Overall, the accessibility to competitive finance prices at credit report unions can dramatically profit members in achieving their monetary objectives.

Personalized Financial Assistance

Members of credit rating unions take advantage of customized financial recommendations and assistance, boosting their understanding of economic monitoring methods. Unlike typical banks, debt unions prioritize individualized service, making the effort to analyze each member's distinct monetary scenario and goals. This individualized strategy enables cooperative credit union participants to receive targeted recommendations on how to boost their monetary wellness.

Enhancing Cost Savings Opportunities

With a concentrate on promoting financial development and security, credit report unions supply numerous methods for members to enhance their savings opportunities. Lending institution provide competitive rate of interest on interest-bearing accounts, commonly greater than traditional banks, enabling members to earn extra on their deposits. Furthermore, several cooperative credit union provide special financial savings programs such as vacation cost savings accounts or youth interest-bearing accounts, urging members to conserve for particular goals or instruct young individuals about the value of conserving.

Furthermore, find out here now lending institution might offer certifications of deposit (CDs) with affordable rates and terms, offering members with a safe way to conserve for the future while making greater returns than standard savings accounts. Generally, debt unions present varied chances for participants to improve their savings and job in the direction of achieving their monetary purposes.

Conclusion

To conclude, lending institution use countless benefits such as higher rate of interest on cost savings accounts, lower charges, and individualized check over here monetary solutions. With accessibility to affordable lending prices, tailored monetary guidance, and curricula, credit rating unions supply a helpful setting to empower your funds and secure a brighter financial future. Joining a lending institution can help you enhance your savings chances and boost your general financial well-being.

Credit rating unions usually offer workshops, workshops, and online resources covering various subjects such as budgeting, saving, spending, and credit rating monitoring.Monetary education is a cornerstone of credit unions' philosophy, stressing the importance of monetary literacy in attaining long-term financial well-being. Furthermore, credit report unions may be a lot more prepared to work with individuals who have less-than-perfect credit report backgrounds, offering them with chances to improve their monetary scenarios through responsible loaning (Wyoming Credit Unions).Members of debt unions profit from tailored economic guidance and guidance, enhancing their understanding of financial administration approaches.Individualized economic advice from credit history unions typically includes developing customized budget plan strategies, setting attainable financial objectives, and supplying recommendations on see here now boosting credit ratings